Chris Bruderle: Tracking Key Brand Disruptions in 2023

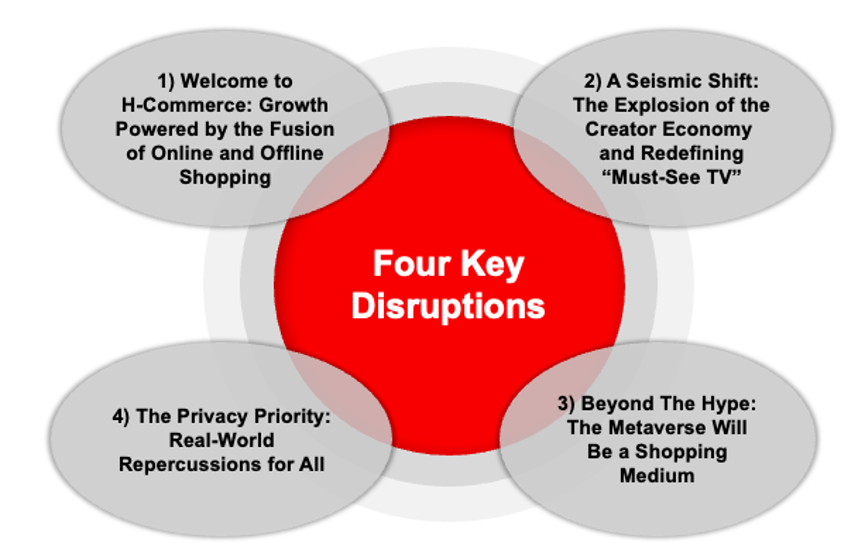

The IAB’s 2023 Brand Disruption Report highlights four key disruptions that are challenging brands, retailers, and the digital ecosystem. Chris Bruderle, Vice President of Business Insights & Content at IAB, stops by The Continuum to unpack these shifts as the industry looks ahead to 2023.

The Continuum: What is your process for putting together the brand disruption report?

Chris Bruderle: We start by identifying disruptions across four key areas within a brand and retailer’s business: (1) production; (2) fulfillment, including both distribution logistics and product delivery; (3) media and marketing; and (4) Data. We have found those to be the four areas where disruption often emerges and innovation is fostered. We then review hundreds of articles, white papers, research studies, and reports, both consumer and B2B, that are tied to those four areas. We then sift through those to find patterns of disruption and innovation. The final filter for us is identifying the topics that will matter most to our member companies regarding IAB’s areas of expertise, i.e., advertising, marketing, and media.

As we come out of Black Friday, it’s appropriate that the first trend in your report is what you’re calling hybrid commerce or “h-commerce.” How does that differ from ecommerce?

If omnichannel means the ability to shop across more than one channel, h-commerce is an evolution of that model that is powered by the fusion of channels. Essentially, digital technology is being used to connect those channels in the creation of an enhanced, seamless, cross-channel shopping experience. For example, let’s say that the item that you want to purchase is not available in the offline store you visited, but is available on the ecommerce site for delivery to your home. Or, the ecommerce site reveals that another offline branch store nearby has the product available for pickup. A good h-commerce consumer interface and logistics system enables that to happen without the shopper even needing to talk to a store sales associate. It's the communication across those channels that ultimately gets the consumer what they want in the fastest and most convenient way possible.

A potential “third rail” for retailers and brands is when a consumer arrives at what I like to call a “shopping dead end.” This is when a retailer has no further options that enable a product to be purchased. If a consumer goes into a major “big basket” store and they don't have the product they want in store, the retailer and/or brand need to make it very seamless and obvious for a consumer to know what further options they have to get the product. That means there should be a “concierge service”, i.e., a salesperson or digital kiosk in the store, or a seamless ecommerce site, that enables the person to locate that product and complete the purchase.

“If omnichannel means the ability to shop across more than one channel, h-commerce is an evolution that is powered by the fusion of channels. Essentially, digital technology is being used to connect those channels in the creation of an enhanced, seamless, cross-channel shopping experience.”

That concierge element seems even more critical in a hybrid commerce environment where the customer has a certain amount of information already. Have you seen brands try to invest or restructure or retrain their staff on that in-store experience based on this concept?

Klarna has a “virtual shopping” service that enables customers who are shopping online to consult with an in-store sales associate via a video call or live chat. Other retailers are now doing similar things.

Sometimes as a consumer you're 98% of the way towards completing a purchase online, but you just need that final 2% of assurance before clicking “buy now.” And I don't think chat bots really solve that. People just want to ask someone simple yet specific questions, like, “These two products are very much alike—what's the slight difference?”

We're also seeing offline sales associates being trained on the online shopping habits of consumers. Therefore, when that online consumer mindset comes into the store, the sales associate is able to shape their conversation based on the type of things that people search for in other channels.

Is h-commerce more prevalent for reaching certain consumer segments like Gen Z or millennials, or is it truly all ages?

It's quite clear that consumers across all age demographics want to get the specific product that they want as quickly as possible—therefore they leverage all the different tools that hybrid commerce can offer.

The creator economy is definitely top of mind for a lot of brands. In this report, when you say creator economy, does that refer to all channels or mostly the social video content space?

It’s creators writ large. That said, even though podcasting has a massive creator production network which has democratized digital audio publishing, the story here is really with social and video. And that is because video is one of the most consumed types of media. TikTok for example is an entire social media network tied only to video. The social video construct lends itself to customization and quick production. A creator can crank out five short form videos or ten quick posts pretty quickly.

Are creators still mostly handled by specialty agencies? Or is that starting to diversify?

It is starting to diversify. You're seeing creators being hired by brands, and you're seeing them be hired by social media companies directly. It's kind of like 20 years ago, when you saw legacy media companies hire younger people in senior digital media roles because they knew the space. And of course creator talent agencies are huge businesses as well, since the volume of the creator marketplace is massive.

“Coming out of COVID, there are a lot of things affecting brands that aren't necessarily COVID-driven so much as COVID-accelerated.”

IAB has also been focusing on the increased interest in attention metrics across the industry, and I was wondering if there’s any evidence that the creator economy is more engaging than traditional media like TV, especially considering the rise of second-screening.

I would challenge that the attentiveness of watching TV is diminished because that viewership experience is often accompanied by concurrent cell phone usage, i.e., the “second screen.” In those circumstances, which of those two channels is the one in the background? You could argue that the TV is in the background of the cell phone. It can cut both ways.

My son turns 14 next month. Last night he was in his room playing Xbox online with his friends. But while he was doing that, he was also watching the Philadelphia 76’ers basketball game on his phone right under the the video game monitor. There's three things going on right there. There's video game playing. There's the social media aspect of the video game happening. And there's him watching the basketball game. That is an incredibly common activity amongst Gen Y and Gen Z. And it’s something that our industry is being challenged to measure proplerly in terms of engagement and attention.

The metaverse has been the subject of a lot of conversation this year, but your report offers a specific prognosis that a key function it will serve is as a shopping platform rather than a social space.

It's going to be many things. And it already is many things, just like the internet is many things. But put aside the hype for a second and look at what’s currently happening. In Roblox for example, nearly six billion virtual items (both free and paid) were transacted on that platform in 2021. That's commerce. Metaverse-like commerce is also already thriving vis NFTs—what we like to call “Metaverse Loyalty Cards.” Nearly 17 million NFT transactions worth $18.4 billion were executed between April 2021 and March 2022 according to data from Citi.

What you don't really see happening as often currently is the purchase of offline goods in the metaverse. But you do have offline retailers and brands building storefronts there. In fact, there are now Metaverse-storefronts-as-a-service companies (or MSaaS) like Obsess which build virtual stores and transform commerce into a lifelike 3D experiences for retailers and brands such as American Girl, Ralph Lauren, and Dermalogica. Crocs and Coach have initiatives for the holidays, along with Bloomingdale's. But that's not where the bulk of metaverse commerce is happening right now.

Where it's happening is through digitally native sales. In metaverse commerce, selling products “direct-to-avatar” is the new DTC. And then you’re seeing a brand like Forever 21 selling products offline based on avatars and products that they see in the metaverse.

Were there any key trends this year that didn't make it into the report?

Coming out of COVID, there are a lot of things affecting brands that aren't necessarily COVID-driven so much as COVID-accelerated. Nearshoring is one, as brands diversify their production stack so they’re not overreliant on one area such as China. There are tech investments that they're making to shore up—no pun intended—their supply chain businesses, so they are more nimble and less susceptible to hiccups. The supply chain has also amplified the tie between product availability and advertising and marketing messaging.

“I would challenge that the attentiveness of watching TV is diminished by the second screen. Which of those two channels is the one in the background? You could argue that the TV is in the background of the cell phone. It can cut both ways.”

There’s also a growing focus for brands and retailers on sustainability. “Purpose” has become much more important and, in addition to DEI, I would argue that one of the top purpose-driven focuses is on sustainability. CO2 emissions have become a factor. Where I saw the straw break the camel's back is the fact that now, in the media industry, you have agencies and brands and ad tech trying to quantify the amount of CO2 emissions coming out of their advertising campaigns. If you have a billion impressions, there's a certain amount of computer processing that's required which uses a lot of electricity, and therefore co2 emissions.

One other trend that’s a bit looser but still really interesting is this concept of brands, retailers, and media companies not staying in their supposed lanes anymore. TikTok, a social media company, is reportefly building a fulfillment service. Walmart, a retailer, bundles Paramount+ and Spotify membership subscriptions into their membership plan. So you essentially have a retailer getting into the Netflix space. And regarding Netflix, you have them doubling down on gaming.

This is still bubbling below the surface, which is why didn't make it to the report. But it's something I'm keeping an eye on. It could be accelerated by the current state of the economy, if now becomes the time to steal market share by investing in things that you didn't necessarily think you were able to invest in during other markets.

IAB members can read the full report: https://www.iab.com/insights/brand-disruption-2023/

December 20, 2022